CenterPoint Energy Completes $1.2B Sale of Louisiana and Mississippi Gas Systems

In a significant move that will reshape the natural gas industry in the Southeast, CenterPoint Energy has completed the sale of its natural gas distribution systems in Louisiana and Mississippi to Delta Utilities for $1.2 billion. The announcement, made on April 1, 2025, underscores the shifting dynamics within the energy sector as companies realign their focus and investments to meet future growth objectives and market demands.

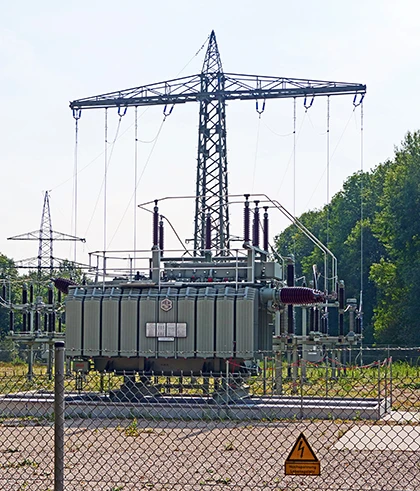

This sale includes approximately 12,000 miles of main pipeline serving around 380,000 metered customers across Louisiana and Mississippi. For CenterPoint Energy, the decision to divest these assets was part of a broader strategy to concentrate its efforts and investments on other parts of its portfolio. The proceeds from the sale are expected to support the company’s long-term growth initiatives, as CenterPoint continues to enhance its electric transmission, distribution, and generation operations in Texas, Minnesota, Ohio, and Indiana.

Jason Wells, President and CEO of CenterPoint Energy, expressed optimism about the sale in a statement, emphasizing that the proceeds would help fund the company's ambitious growth plans. "We will continue to optimize the funding of our capital investments to support safety, reliability, and resiliency for the benefit of our customers and communities," Wells said. This reflects the company's ongoing commitment to delivering high-quality services to its millions of customers while strategically positioning itself for the future.

Delta Utilities, the buyer in this transaction, is an affiliate of Bernhard Capital Partners, a private equity firm known for its investments in energy infrastructure. Tim Poché, CEO of Delta Utilities, emphasized the company’s vision of establishing modern, resilient natural gas utilities across multiple states. Poché highlighted the resilience and long-term potential of natural gas as a "transition fuel" in the U.S., particularly as the country continues to shift toward cleaner energy sources while relying on natural gas to meet immediate energy needs.

The acquisition is a key part of Delta's strategy to expand its footprint in the natural gas sector. The purchase of CenterPoint’s gas systems will significantly enhance Delta’s ability to serve customers in Louisiana and Mississippi, bolstering its position in the rapidly evolving energy landscape. Delta's acquisition is also a strategic move as the company prepares to finalize another significant purchase—Entergy's two regulated natural gas local distribution companies in Louisiana. The deal for Entergy's gas systems, which serve homes and businesses in New Orleans and Baton Rouge, is expected to close later this summer.

For Delta Utilities, this acquisition is not just about growing its customer base but also about fortifying the resilience of the natural gas infrastructure in the region. Poché noted that the purchase would help Delta build stronger, more resilient communities. By investing in these key utilities, Delta aims to support the long-term energy needs of these areas, ensuring a reliable energy supply for residential and commercial consumers alike.

The sale comes at a time when many U.S. utilities are reevaluating their operations in response to shifting regulatory pressures, economic challenges, and increasing demands for sustainability. For CenterPoint, divesting these gas systems will allow the company to reinvest in its electric and gas infrastructure in other parts of its service territory, particularly in Texas, where it has outlined a comprehensive $5.75 billion resiliency plan. This ambitious initiative is focused on strengthening CenterPoint's electric grid to better withstand extreme weather events and improve service reliability for millions of customers.

While private equity-backed companies like Delta Utilities have often been associated with short-term investments and cost-cutting measures, Delta's leadership has emphasized that its vision for the future is focused on long-term stability and resilience. Poché reaffirmed that this acquisition is not a short-term play but rather a commitment to creating sustainable energy solutions that will benefit both the company and its customers for years to come.

For the communities in Louisiana and Mississippi, the transition to Delta Utilities as their new gas provider signals a new era of energy management. With the backing of Bernhard Capital Partners, Delta is poised to invest in improving infrastructure and services, potentially leading to better energy reliability and customer service. The strategic focus on natural gas as a transition fuel also aligns with broader national trends toward cleaner energy, although natural gas continues to be seen as a key component in the U.S.'s energy mix for the foreseeable future.

The completion of this sale is just one part of a larger trend in the energy sector, where utilities are continuously adapting to a rapidly changing environment. As the energy industry evolves to meet the demands of sustainability, reliability, and innovation, both CenterPoint Energy and Delta Utilities will need to navigate the challenges of modernizing infrastructure while ensuring affordable and reliable service for their customers.

CenterPoint Energy’s $1.2 billion sale of its Louisiana and Mississippi natural gas systems to Delta Utilities marks a pivotal moment in the ongoing evolution of the energy landscape. The deal represents a significant reshaping of ownership in the region’s natural gas sector, with implications for future investments in energy infrastructure. As both companies work toward their long-term goals, customers and communities in Louisiana and Mississippi will be watching closely to see how this transition impacts service quality, reliability, and energy resilience in the years to come.